6th February 2026

Key takeaways

EU stress tests were introduced in 2010 as part of supervisory efforts to assess the resilience of the banking sector following the global financial crisis. Stress tests were effective to identify capital shortfalls, restore bank confidence and increase bank capital levels. Over time, EU stress tests gained in complexity, lost relevance and drove inefficient processes. It is time to rethink and revamp EU stress tests.

This document provides 20 actionable improvement recommendations across five areas: (1) Increase the relevance of EU stress tests; (2) Improve methodology through integration with risk management; (3) Simplify the process and data requirements; (4) Achieve global standards convergence; and (5) Reduce stress test requirements.

1. Introduction

1.1. Background

In response to the 2008 global financial crisis, stress tests emerged worldwide as effective supervisory tools to improve bank confidence and resilience. The stress testing discipline evolved rapidly, from pre-crisis siloed and static approaches to integrated, forward-looking frameworks designed to dynamically assess bank capital adequacy over longer-term horizons. Individual bank stress test results were made public to promote market transparency. Supervisory stress tests proved effective in seizing bank capital shortfalls, raising capital levels, constraining distributions and improving market confidence.

The US introduced the first post-credit crisis stress test in 2009 through the Supervisory Capital Assessment Program (SCAP), which prompted capital raises of approximately $75bn across the top 19 U.S. bank holding companies. The results were publicly disclosed to boost confidence in the banking system. In 2011, the Comprehensive Capital Analysis and Review (CCAR) was introduced as the permanent annual supervisory stress testing framework. CCAR not only identifies potential capital shortfalls but also informs decisions on dividends and share buybacks. It also includes a qualitative review of banks’ capital planning and governance. Today, CCAR results drive stress capital buffer requirements and continue to be a binding constraint for capital distributions. The Federal Reserve is currently exploring improvements to transparency, public accountability, and the risk capture of CCAR.

The EU launched its first stress tests coordinated by the EBA in 2010 and 2011, raising equity of €2.5bn and €3.5bn, respectively, excluding material pre-emptive capital raising activities. In 2014, the ECB completed the Comprehensive Assessment, which combined an asset quality review and a stress test, raising an additional €9.5bn in equity. Similarly to the US, these initial rounds of public stress tests helped build confidence on the EU banking system. Since then, EBA and ECB have coordinated capital stress tests every two years. Every other year, ECB conducts ad-hoc stress tests (e.g. liquidity, interest rate risk in the banking book, cyber, climate and geopolitical) without disclosing individual bank results. Capital stress tests influence P2G levels but do not explicitly drive capital distribution decisions. While technical rigour, scope and disclosures have grown over time, market relevance is limited as EU banks’ CET1 levels remain comfortably above 14%.

In the UK, the Bank of England began conducting stress tests in 2012 and 2013, prompting bank capital raising and restructurings. In 2014, the UK conducted a more systematic stress test with public disclosures, increasing transparency and confidence in the banking system. The Bank of England now runs now regular capital stress tests of UK banks every two years. As in the EU, stress test results inform Pillar 2B bank requirements, which are not public. In addition, minimum hurdle rates are established for each bank, which must still be met under adverse scenario. If projected stress test results are below hurdle rates, dividend and buybacks can be restricted.

1.2 Stress Test Results

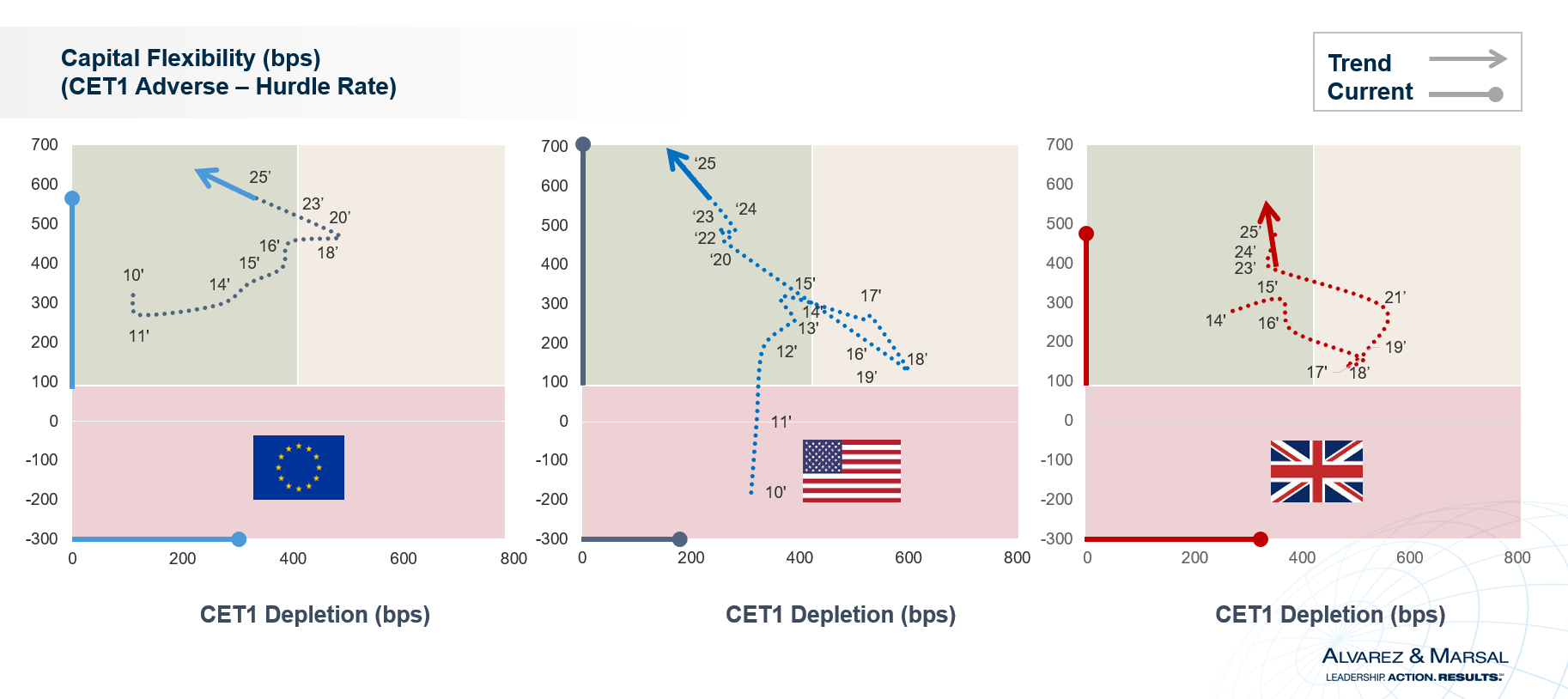

Stress test results are typically evaluated using two main drivers:

1. Capital Depletion: measures the capital drawdown from the starting CET1% to the lowest CET1% level under the adverse scenario. It indicates the individual bank’s risk profile and the severity of the scenario and assumptions used. The greater the depletion, the more credible the capital adequacy test is considered.

2. Capital Flexibility: refers to the post-stress test buffer, calculated as the CET1% level under the adverse scenario minus the minimum threshold. It is an indicator of the bank’s capacity to distribute capital via dividends or share buybacks.

Figure 1 shows EU stress test results over time. While the capital depletion in early stress tests was often seen as lacking credibility, it increased over time, peaking at 485bps in 2021 and stabilising around 300bps in 2025, driven by improved bank profitability. As bank capital levels have increased, capital flexibility has also improved, reaching a peak of 584bps in 2025, based on the previous 5.5% minimum threshold.

Figure 1. EU stress test results: capital depletion and capital flexibility

Figure 2 displays a complex and varied picture when comparing stress test results across the globe. Stress tests across Europe, the US, and the UK indicate a shift towards lower depletion and higher capital flexibility, with US banks obtaining comparatively favourable outcomes in the 2025 stress test.

Figure 2. Global stress test results: capital depletion and capital flexibility

There are three key takeaways from this comparative analysis:

1. As capital levels materially increased after the Global Financial Crisis, boosting bank resilience, stress test outcomes exited the red zone of capital raising. The relevance of stress tests for capital adequacy is low when post-stress capital buffers are large (as is the case today).

2. As bank capital buffers expand, capital flexibility improves, as does the capacity to increase dividends and buybacks. The relevance of stress tests for capital distribution decisions becomes more significant as the capital available to shareholders increases.

3. As bank profitability improves, stress test depletion declines, reducing capital requirements from stress tests and leading them to converge toward the capital conservation buffer of 250bps.

2. Assessment of EU Stress Tests

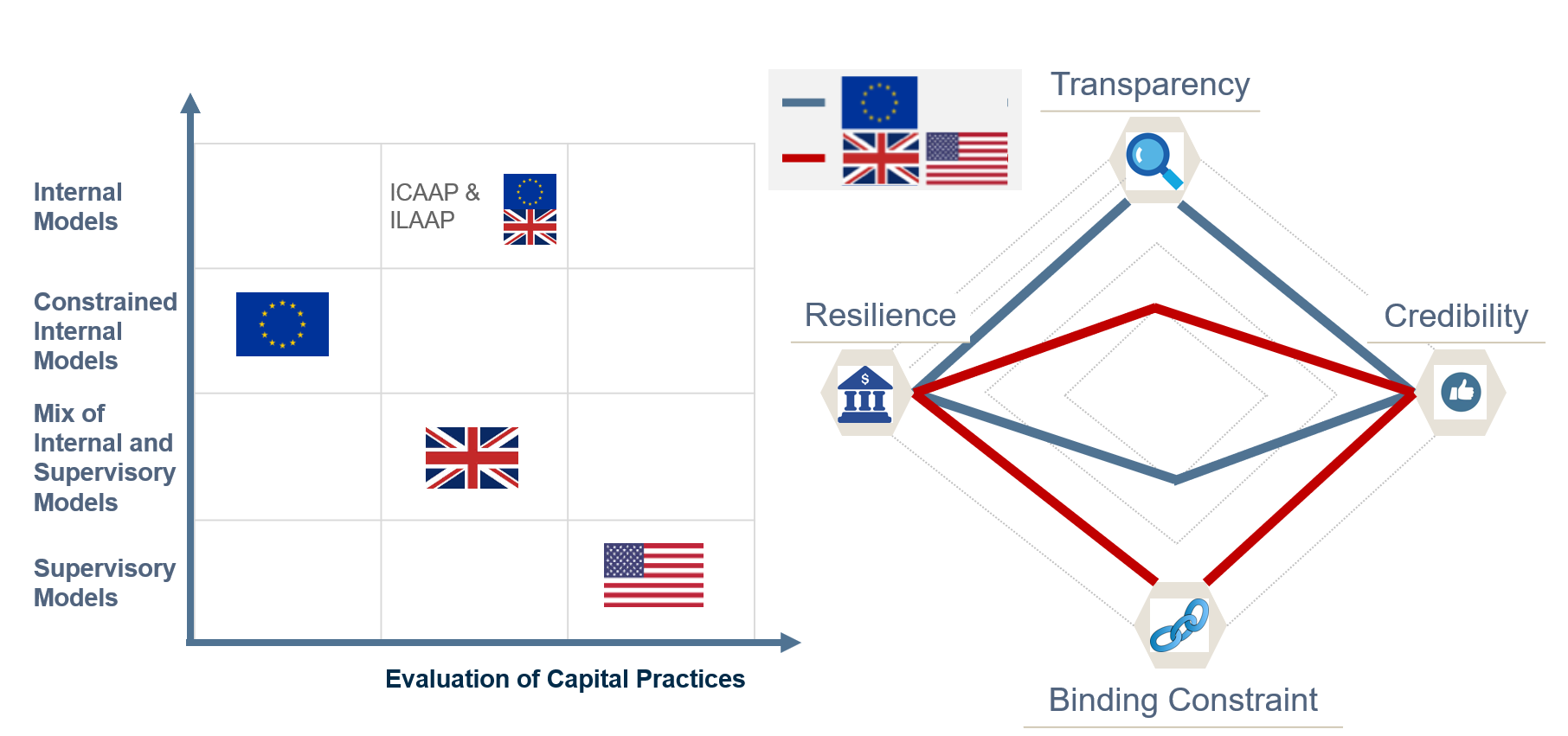

Before outlining a proposal for improvements, this section provides an assessment of EU stress tests. We compare EU stress tests with those used in the US and UK, highlighting key differences in uses, methodology, process, and disclosures. We assess stress tests in terms of their impact on market transparency, credibility, binding constraints, and resilience. We conclude that EU stress tests are perceived today as a purely regulatory exercise, with some value for market transparency. Unlike in the US and UK, EU stress tests do not drive binding constraints for capital distributions.

2.1. Comparison with other Stress Tests

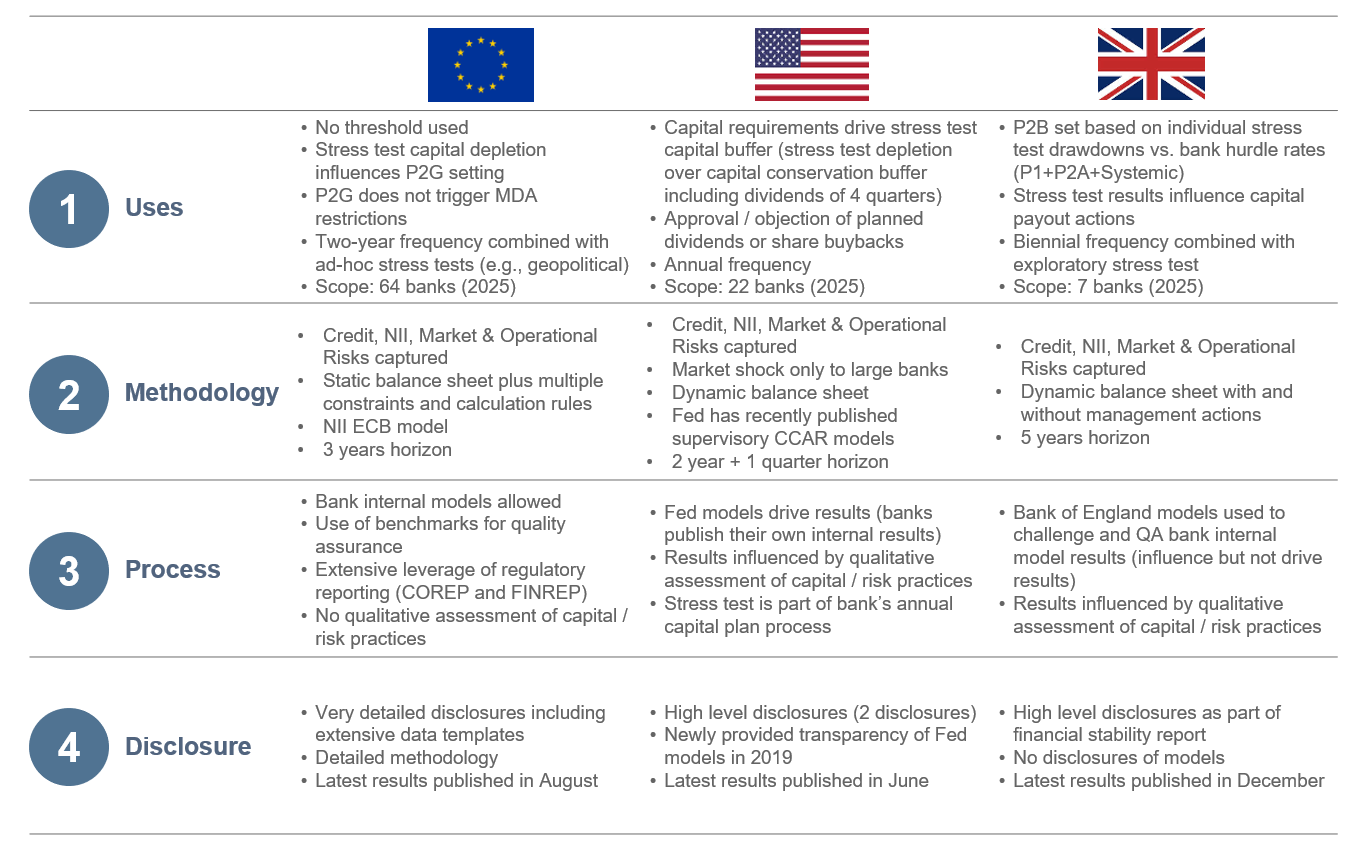

A comparative analysis of EU, US, and UK stress tests is shown in Figure 3, along the following areas:

1. Uses: Stress test outcomes drive Pillar 2 guidance levels in the EU but do not influence capital distributions. The main goal is to provide market transparency on the health of EU banks through extensive disclosures. By contrast, US stress tests generate binding capital requirements and drive capital distribution approvals.

2. Methodologies: Stress test methods and assumptions vary by region, ranging from prescriptive restrictions like a static balance sheet in the EU to dynamic balance sheet projections aligned with internal bank capital plans (US and UK).

3. Process: The EU stress test combines bottom-up internal bank models and some supervisory models (e.g., NII, credit benchmarks). In the US, supervisory and internal bank models are used, with greater weight on the former. In the UK, internal bank models are the main driver.

4. Disclosure: Disclosures also vary significantly across jurisdictions. EU stress tests provide a high level of transparency, while the UK and US disclose limited capital adequacy and loss results.

Figure 3. Mapping differences across stress testing regimes in the EU, US and UK

2.2. EU Stress Test Assessment

Our assessment of EU stress tests is detailed in Figure 4, including their impact on market transparency, credibility, binding constraints, and resilience, as well as compliance with Basel Stress Test Principles. EU stress tests have helped to increase capital levels across the banking system and have contributed to market confidence and bank resilience post-global financial crisis. However, as the resilience objective has lost relevance –given the healthy state of the EU banking system– stress tests are now seen as a purely regulatory exercise, with no explicit impact on capital requirements or distributions. Furthermore, the constrained assumptions used make stress tests ineffective for internal risk management purposes. The focus on market transparency is undermined by the lack of public bank P2G levels and the unclear link between P2G and stress test depletion (a CET1 depletion decline of 35% compared with a P2G reduction of 15% in the latest stress test).

Figure 4. Rating Effectiveness of stress testing regimes in the EU, US and UK

3. Recommendations to improve EU Stress Tests

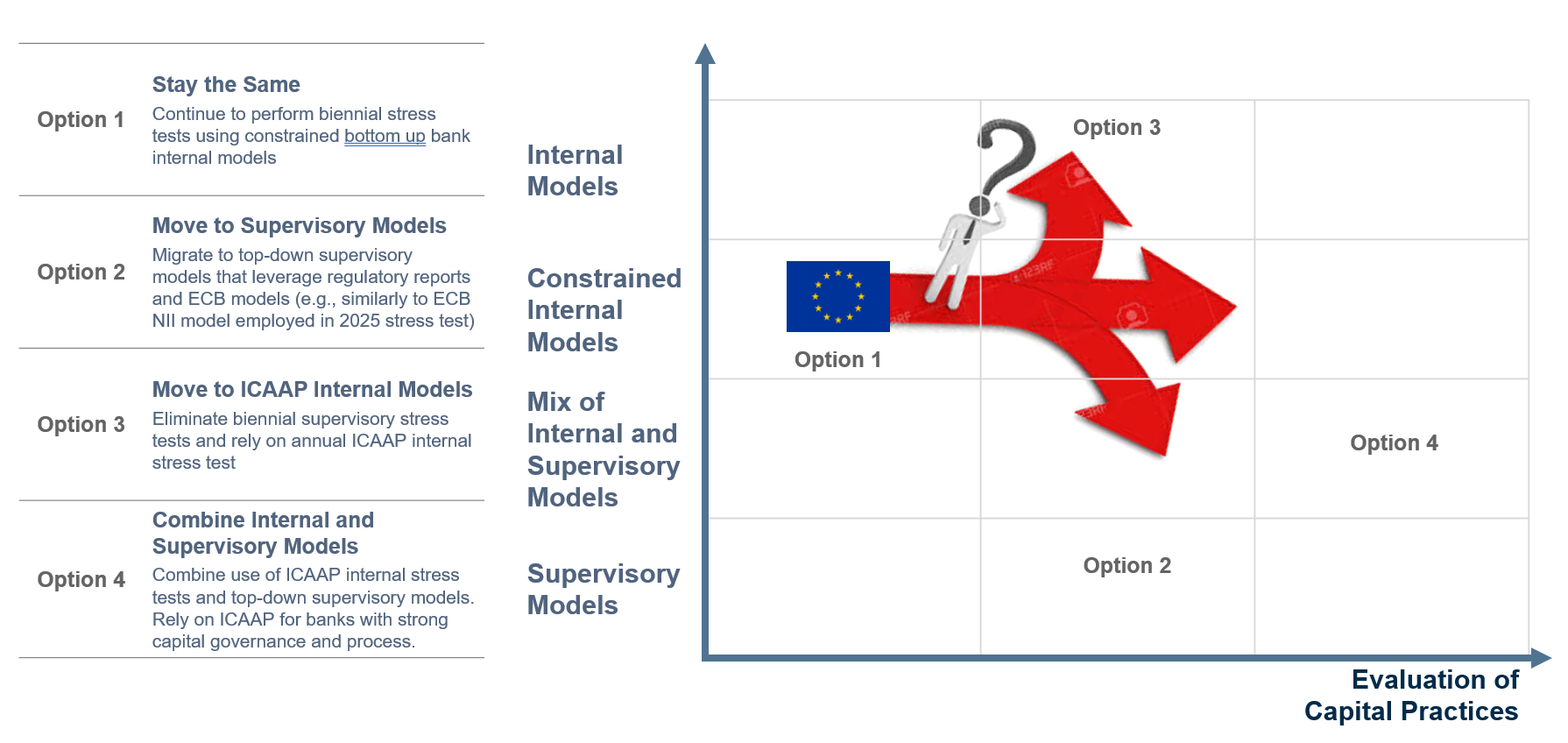

While the overall assessment of EU stress tests is positive, there are areas for improvement that can increase effectiveness, relevance, and integration with banks’ risk and capital management practices. This section describes the opportunities for improvement. Figure 5 maps some of the options available for consideration regarding the future direction of EU stress tests. Our proposed overall approach, outlined in Section 3.1, relies on Option 4.

Figure 5. Options for the way forward of EU Stress Tests

3.1. Overall Approach, Timeline and Frequency

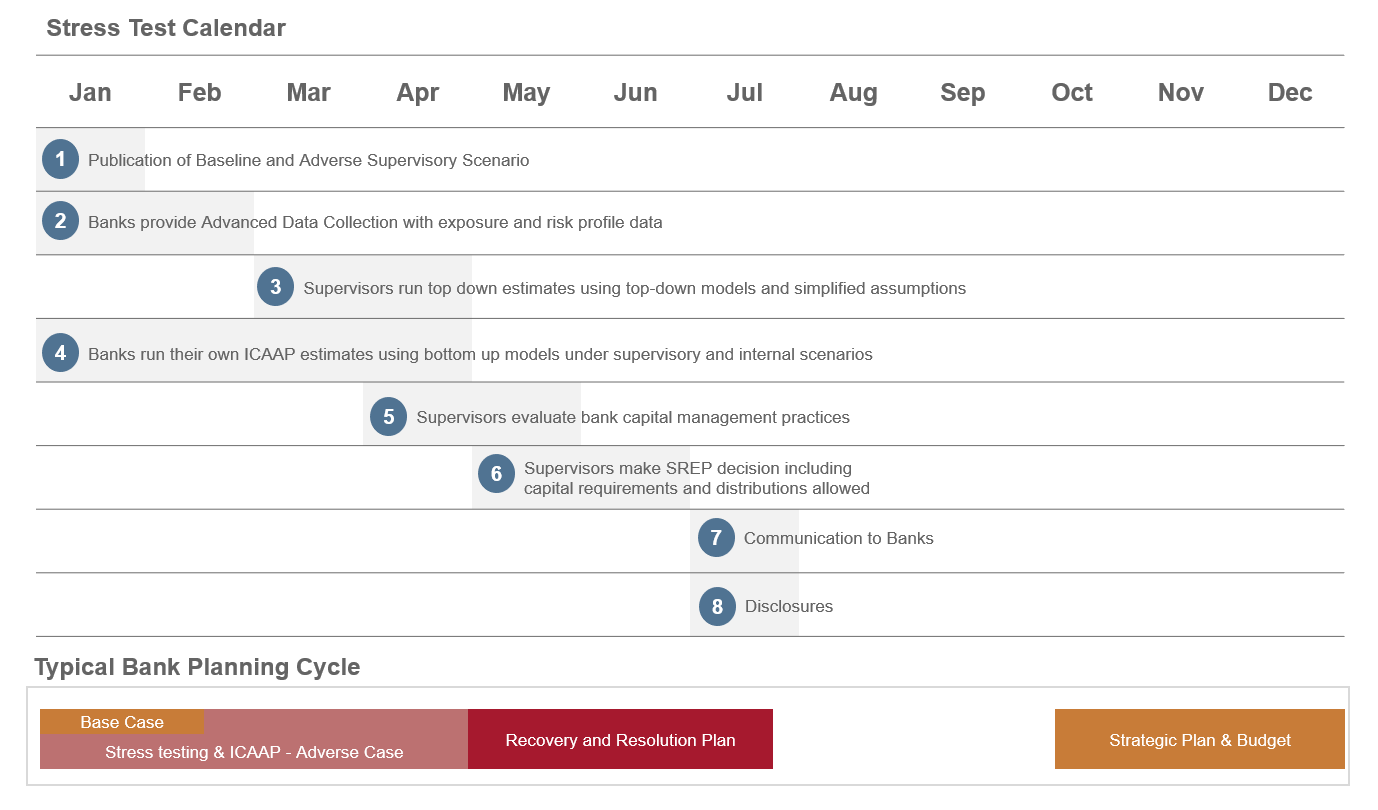

Recommendation #1 proposes the combined use of internal bank ICAAP models and top-down supervisory models. The process can be designed along the following steps:

1. Step 1: Supervisors define scenarios and execute top-down supervisory models

1.1. Supervisors define the baseline and adverse scenario.

1.2. Supervisors leverage COREP, FINREP, IRRBB and other regulatory reports to populate the starting-point exposure and risk profile data.

1.3. Banks provide additional input data as required to complete starting point.

1.4. Supervisors run top-down models to estimate capital depletion using their own assumptions (constrained or unconstrained).

2. Step 2: Banks run bottom-up internal models as part of their ICAAP process

2.1. Banks run in parallel their ICAAP using supervisory scenarios and bank-internal scenarios that incorporate idiosyncratic factors.

2.2. Banks use dynamic business projections and internal models.

2.3. Banks calculate CET1 depletion results with and without management actions, including future capital distributions to be approved.

2.4. ICAAP includes a self-assessment of capital governance and management practices.

3. Step 3: ECB makes financial capital decision based on results of Steps 1 and 2

3.1. Supervisors define capital requirements based on a combination of results obtained from supervisory and ICAAP stress tests.

3.2. Supervisors develop a reconciliation view of differences between bank ICAAP and supervisory stress test results.

3.3. Banks with strong SREP Capital Ratings (based on an assessment of governance, stress test models and internal controls) are allowed to use ICAAP vs. banks with poor ratings, which are geared towards the use of supervisory stress test results.

3.4. Capital distributions are approved based on stress test outcomes.

Recommendation #2 proposes the timeline alignment of the supervisory stress tests with banks’ ICAAP and planning cycle, in line with Figure 6.

Figure 6. Proposed Supervisory Stress Test Calendar

Recommendation #3 proposes to maintain the frequency of EU stress tests at every two years. During those years when no supervisory stress test is conducted, capital decisions are made based on bank internal ICAAP results, adjusted by supervisors based on the SREP Capital Rating and prior-year supervisory stress test adjustments.

3.2. Use of Stress Testing – Increasing Relevance

Recommendation #4 proposes to create transparency in P2G calculations and demonstrate direct linkage / correlation to stress test results.

1. Eliminate the current P2G bucketing calculation approach.

2. P2G to be calculated as stress test capital depletion (defined by steps 1, 2 and 3 outlined in Section 3.1, minus the Conservation Buffer of 250bps).

3. Eliminate any floor in P2G levels, allowing banks with stress test capital depletion lower than 250bps to have zero P2G requirements.

4. Eliminate any qualitative adjustments in P2G setting, except for the adjustments made to stress test capital depletion as outlined in Step 3 of Section 3.1., based on the quality of capital and risk management practices.

Recommendation #5 proposes to develop an approach that clearly links capital distribution decisions with stress test outcomes.

1. Introduce a clear linkage between capital requirements, stress test results and the ability to increase capital distributions via dividend and buybacks.

2. Calculate CET1 post stress test with and without proposed capital distributions.

3. Use stress test depletion as defined by steps 1, 2 and 3 outlined in Section 3.1.

4. If CET1 post stress test with proposed capital distributions falls below minimum regulatory level requirements plus the management buffer, reject capital distribution proposals.

5. Define transparent and clear governance for capital distribution decisioning / approvals between banks and supervisors.

Recommendation #6 proposes to consider eliminating P2G and adding a stress test capital buffer (if required) as part of Pillar 2 requirements, similar to the approach currently used in the US.

1. Eliminate P2G non-binding requirements to increase relevance of stress test outcomes

2. If stress test capital depletion is higher than 250bps, add a stress test capital buffer binding requirement to Pillar 2 required levels

3. Consider the inclusion of proposed capital distributions in the stress test capital buffer

3.3. Methodology Improvements – Integrating with Management

Recommendation #7 proposes to develop top-down supervisory models for all material risks.

1. Maintain the NII ECB model and implement IRRBB reporting as input to the model

2. Maintain the current fee and commission modelling approach.

3. Develop Credit Risk ECB models using enhanced credit benchmarks and implement COREP/FINREP reporting as input to the model.

4. Develop Market Risk ECB models using sensitivity analysis data provided by banks

5. Maintain the current operational and conduct risk modelling approach.

6. Develop RWA top-down models, consider output floor requirements and implement COREP reporting as input to the model.

Recommendation #8 proposes to run top-down supervisory models under static and dynamic approaches.

1. Implement the possibility to run supervisory models under static and dynamic approaches

2. Static approach as currently projected in ECB stress tests.

3. Dynamic approach aligned to ICAAP bank estimates or using simplified dynamic projections (starting point balance + expected run-off + new production observed last year with a haircut).

Recommendation #9 proposes to maintain current ICAAP bottom-up bank modelling, adding an explicit self-assessment of capital governance and management practices.

1. Maintain ICAAP bank models and upgrade modelling approaches if supervisory deficiencies are identified.

2. Develop a self-assessment of capital governance and management practices aligned with ICAAP regulatory expectations and Basel stress testing principles (sound foundational risk management; robust methodologies and analytics; comprehensive capital adequacy assessment and capital policy; integration with performance measurement, capital allocation and pricing; robust controls and governance).

3.4. Process Simplification – Gaining Efficiency

Recommendation #10 proposes to substantially simplify stress test template data requirements by reducing the granularity of data inputs and aligning inputs to current regulatory reporting by risk area.

1. Eliminate, where possible, granular risk data requirements

2. Leverage existing regulatory reports for each of the material risk categories

2.1. NII (FINREP and IRRBB).

2.2. Net fees and commissions (FINREP).

2.3. Operating expenses (FINREP).

2.4. Credit risk and RWA (COREP and FINREP).

2.5. Market risk (COREP, FINREP, IRRBB and ad-hoc supervisory trading risk reports)

2.6. Operational and Conduct Risk (COREP and ad-hoc supervisory operational risk reports)

3. Only request bank data (by exception) for those areas required to complete top-down supervisory models not covered by existing regulatory reports.

Recommendation #11 proposes to materially reduce the timing of the stress test exercise through streamlined data submission and quality assurance cycles.

1. Reduce the stress test running cycle to 3 months (from scenario to modelling results), aligned to ICAAP, decisioning cycle to 2 months (quality assurance, validation and approval) and disclosure cycle to 1 month.

2. Minimise quality assurance touchpoints to a maximum of 2.

3. Consider limiting quality assurance only to high-risk areas or areas with supervisory findings outstanding.

4. Eliminate data quality assurance processes, as regulatory reporting will be extensively leveraged.

Recommendation #12 proposes no involvement from banks in supervisory stress test projections. As per the proposed approach in Section 3.1, banks only run their own internal ICAAP estimates and provide the input required for top-down supervisory tests (not covered by regulatory reporting).

Recommendation #13 proposes to promote methodology, process and template stability. No ad-hoc changes in process, methods, or data requirements are allowed after conducting 2 cycles of stress tests as per the proposed approach in Section 3.1.

Recommendation #14 proposes to substantially reduce stress test disclosures. Detailed disclosures can be provided as part of the current EBA transparency exercises. Individual bank data disclosures should be limited to aggregate results and summarised material risk metrics.

Recommendation #15 proposes to apply proportionality to supervisory stress tests using 3 tiers:

1. Tier 1: large institutions (no more than 50) conduct biennial supervisory stress tests and annual ICAAP.

2. Tier 2: medium-sized institutions conduct biennial supervisory stress tests (only if ICAAP deficiencies are found or a low SREP capital rating is assigned) and annual ICAAP.

3. Tier 3: small institutions conduct annual ICAAP only and are subject to a minimum floor of stress test capital requirements. Supervisors can call for a supervisory stress test only in extraordinary high-risk circumstances.

4. Explore further areas for application of proportionality in the scope of stress tests, particularly for modelling immaterial portfolios / risk exposures using Tier 3 framework proposed above.

3.5. Global Standards – Achieving Convergence

Recommendation #16 proposes to apply convergence of scenario definition across global supervisory bodies (Federal Reserve, ECB and the Bank of England).

1. Supervisory bodies agree on scenario themes, drivers and time horizon.

2. Each supervisory body drives the definition and parametrisation of scenarios pertaining to their local market.

3. Supervisory bodies agree on scenario definition and parametrisation not covered by their own local market or that require collaboration from local supervisory bodies (e.g., Asia).

Recommendation #17 proposes to apply convergence of timelines/calendars and disclosure templates across global supervisory stress tests.

1. Supervisory bodies agree on the stress test timeline (US and EU conduct stress tests in the first half of the year, with disclosures at the end of the first semester, while UK conducts stress tests in the second half of the year, with disclosures in December).

2. Develop standard disclosure templates to increase comparability of stress test results globally.

Recommendation #18 proposes to create a global repository of best practices on stress test modelling, including access to top-down supervisory stress test models by risk category.

3.6. Deregulation – Reducing Stress Test Capital Requirements

Recommendation #19 proposes a framework that allows for a reduction in stress test capital requirements if banks achieve low stress test depletion results.

1. If stress test depletion results are lower than 250bps (due to strong bank profitability, low bank exposure to the adverse scenario and/or low bank risk profile), additional stress test requirements should be allowed to be zero.1

Recommendation #20 proposes a framework for the stability of stress test capital requirements and capital distribution decision / approvals by considering averaging of results of multiple years (ICAAP and supervisory stress test results).

4. Conclusion

The assessment included in this document demonstrates that it is time for rethinking and revamping EU stress tests. Twenty actionable recommendations are included to improve the relevance, efficiency and risk management integration of EU stress tests. The proposed approach heavily weights bank ICAAP stress tests and risk management practices, only calling into top-down supervisory stress test results if internal bank processes and governance are not strong. These stress test improvements acknowledge the new reality and situation of the EU banking sector and set the basis for a more efficient and impactful EU stress test framework.

Endnotes:

1. There are US banks with stress capital buffer equal to the conservation buffer of 250bps with no additional stress test capital requirements as per 2025 CCAR results (e.g. JPMorgan Chase, Bank of America, Wells Fargo, State Street and BNY Mellon)

References:

EU Stress Tests (EBA): LINK EBA Stress Testing

Discussion Paper on the future changes to the EU-wide stress test, EBA, March 2020: LINK EBA The future of stress tests

EU Stress Tests (ECB): LINK ECB Stress Testing

Simplification of the European prudential regulatory, supervisory and reporting framework, ECB, December 2025: LINK ECB Simplification 1

Streamlining supervision, safeguarding resilience, The ECB’s agenda for more effective, efficient and risk-based European banking supervision, December 2025: LINK ECB Simplification 2

US Stress Tests (Federal Reserve): LINK Federal Reserve Stress Testing

Federal Reserve Board requests comment on proposals to enhance the transparency and public accountability of its annual stress test, October 2025: LINK Federal Reserve Stress Test Proposal

UK Stress Tests (Bank of England): LINK Bank of England Stress Testing

Stress Testing Principles, Basel, October 2018: LINK Basel Stress Test Principles

Bank Deregulation Primer, Alvarez & Marsal, October 2025: LINK A&M Bank Deregulation Primer

Fernando de la Mora is a Managing Director of Alvarez & Marsal Spain and Co-Head of A&M's financial services practice across EMEA. Mr. de la Mora brings more than 30 years of experience conducting a wide variety of projects related to risk management, governance, capital and liquidity adequacy for global financial institutions. His clients include global financial services firms, investment bank, regional banks, insurance companies, asset managers and hedge funds.

In the area of stress testing, he has worked with several European banks in EU wide stress tests and has implemented related ECB / EBA guidelines on stress testing and capital management. Before Alvarez &Marsal, Mr. de la Mora was a partner at PwC in New York where he led a practice of more than 350 professionals providing consulting services in risk management and regulatory advice. Fernando helped implement U.S. CCAR stress test guidelines to 13 of the 19 banks involved in the capital planning process led by the Federal Reserve.